The demand letter for unpaid invoices is the final step in your attempt to receive payment for services. It also usually includes a warning of impending legal action if the invoice is not settled. Demand letter for unpaid invoicesĪn important tool in your kit when assessing bad debts or potential bad debts is the ‘letter of demand’.Ī letter of demand essentially communicates how much the business in question is in debt to you, what the debt is for and when they need to settle the invoice by. Once the debt slips beyond this 12-month mark, the ATO will recognise the unlikelihood that it will be paid and will allow you to write it off. In order to classify the amount owing to you as a bad debt for tax purposes, the Australian Taxation Office says it must be 12 months overdue. When exactly can you write off a bad debt? Let’s say you have a possible bad debt on your account receivable books. This creates an accounts receivable blackhole, and it’s the cause of major cash flow problems for businesses.

Write off unpaid invoices full#

The findings showed that while most invoices are paid in full before the due date: A survey conducted by the Commercial Collection Agency Association in the USA found that – as time goes by – the likelihood of receiving payment in full greatly diminishes. The problem is by no means limited to Australia. This is also referred to as accounts receivable (money you’re owed for services provided). No matter what industry you work in, if you’re self-employed or the head of a company, chances are you’ll have experienced trouble with unpaid invoices. What happens next? You may have to write off unpaid invoices, as it may provide your business with a tax-deductible expense.īut when and how can you do this? Unpaid invoices This is bad debt one that you’re unlikely to have repaid.

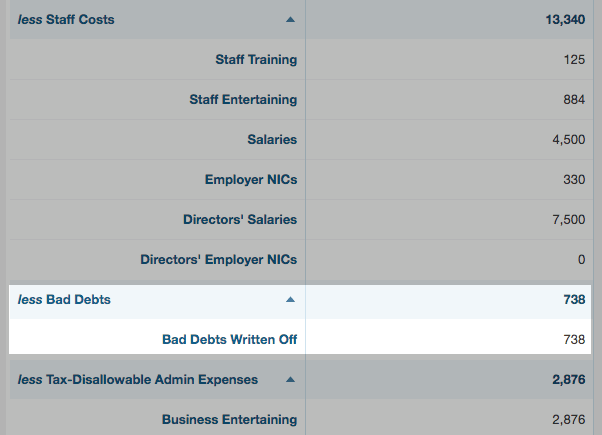

For small businesses’ unpaid invoices, the owner may simply send a few emails or make a few phone calls until the payment is made.īut what happens when your client’s financial position makes it doubtful that they’ll pay the debt they owe to you? Or what if you have the misfortune of dealing with a customer that takes every possible action to evade their payment obligations? You may have to write off unpaid invoices. Typically, a larger business gets their payments team to send a demand letter for unpaid invoices and then receives the payment. In certain circumstances, you’ll need to have these bad debts written off for tax purposes. Throughout your business life, you’ll likely have trouble with unpaid invoices and bad debts.

0 kommentar(er)

0 kommentar(er)